Options can be useful tools for many financial applications, including risk management, trading and management compensation. With the financial derivatives known as options, the buyer pays a price to the seller to purchase a right to buy or sell a financial instrument at a specified price at a specified point in the future. The main advantage of machine learning methods such as neural networks, compared with model-driven approaches, is that they are able to reproduce most of the empirical characteristics of options prices. In this article, we present a solution for options pricing based on an empirical method using neural networks. As a result, we can use a different, data-driven approach for options pricing. We have more computational power in our mobile phones than state-of-the-art computers had in the 1970s, and the available data is growing exponentially. One of the biggest flaws of Black-Scholes is the mismatch between the model volatility of the underlying option and the observed volatility from the market (the so-called implied volatility surface). Although their solution is remarkable, it is unable to reproduce some empirical findings.

#REAL OPTIONS VALUATION BLACK SCHOLES PC#

Considering that the Chicago Board Options Exchange (CBOE) opened in 1973, the floppy disk had been invented just two years earlier and IBM was still eight years away from introducing its first PC (which had two floppy drives), using a data-driven approach based on real-life options prices would have been quite complicated at the time for Black, Scholes and Merton. Their pricing formula was a theory-driven model based on the assumption that stock prices follow geometric Brownian motion.

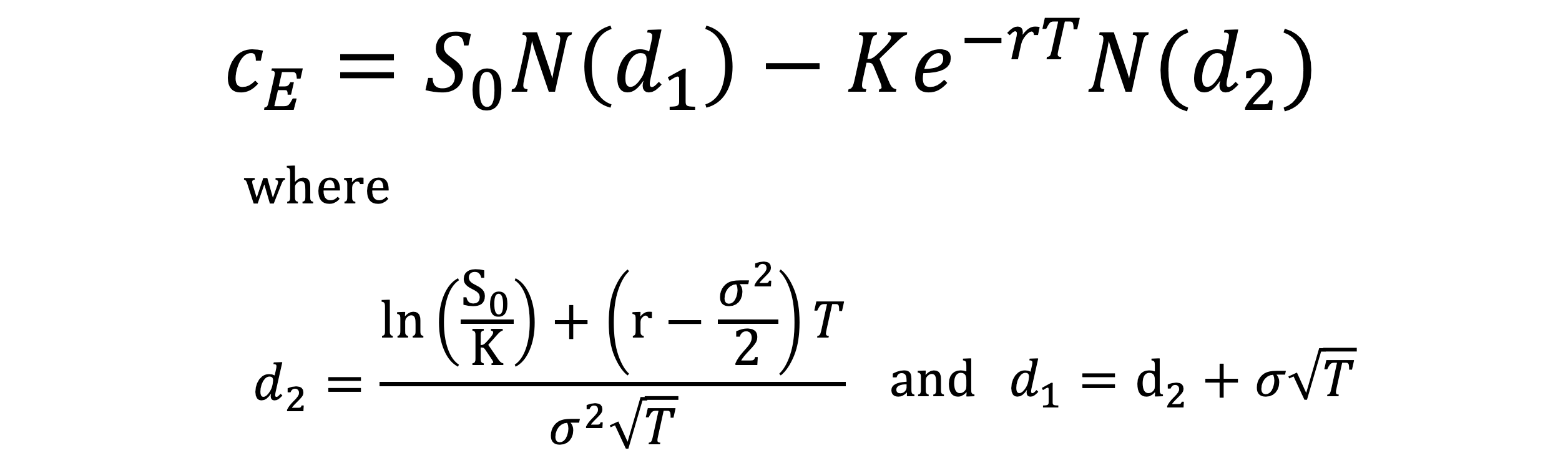

1 In their model (typically known as Black-Scholes), the value of an option depends on the future volatility of a stock rather than on its expected return. In 1973, Fischer Black, Myron Scholes and Robert Merton published their now-well-known options pricing formula, which would have a significant influence on the development of quantitative finance.

0 kommentar(er)

0 kommentar(er)